Electric vehicle startup Rivian received a notable vote of confidence when Volkswagen Group invested $1 billion on June 30, 2025, at a price approximately 33 percent higher than its 30-day volume-weighted average. This support comes as Rivian faces challenges with manufacturing and delays in its new production facility.

The R2, Rivian’s newest model, reflects a shift in company strategy. It will be priced around $45,000, making it more accessible than Rivian’s current R1S and R1T models (priced between $75,000 and $90,000). This lower pricing and simplified design may help reduce production costs over time.

Currently, design validation builds are underway at the California pilot line. Rivian expects to commission the new R2 production line this quarter to begin validating equipment and processes. Nonetheless, the manufacturing timeline presents ongoing challenges.

The company’s $5 billion Georgia facility near Social Circle is scheduled to begin operations in 2028, four years behind its initial 2024 target. This delay raises concerns about Rivian’s existing plant in Normal, Illinois, which will temporarily close for three weeks in September to expand R2 production capacity.

The Georgia project restarted after receiving a $6.57 billion federal loan from the Department of Energy. Ceremonial events are planned for September 14 and September 16, including a formal kickoff with Georgia Governor Brian Kemp. Rivian also announced a new East Coast headquarters in Atlanta, expected to create 500 jobs, reflecting the company’s long-term commitment to the region.

Rivian’s dual-site strategy allows it to optimize R2 production in Illinois before scaling in Georgia. Beginning with limited output may help identify production issues before ramping up in the larger facility.

As of the last quarter, Rivian reported $7.5 billion in cash reserves and $4.9 billion in debt. Balancing these resources against project delays highlights a complex financial picture.

For investors, the next 12-18 months will be critical. The R2 launch could influence whether Rivian develops into a sustainable automaker or remains a well-financed but capacity-constrained startup. The Volkswagen investment is a positive signal, but operational execution remains uncertain. The path to profitability is uncertain and could take years.

Investors should weigh Rivian’s product vision against the challenges of scaling production in a competitive electric vehicle market.

Key Definitions

Volume-weighted average price (VWAP): An average stock price calculated by weighting each trade price by the volume traded, commonly used in institutional investment.

Design validation build: Early pre-production versions of a vehicle used to test and validate design and manufacturing processes.

Dual-site strategy: Operating two production locations to share or stage manufacturing tasks.

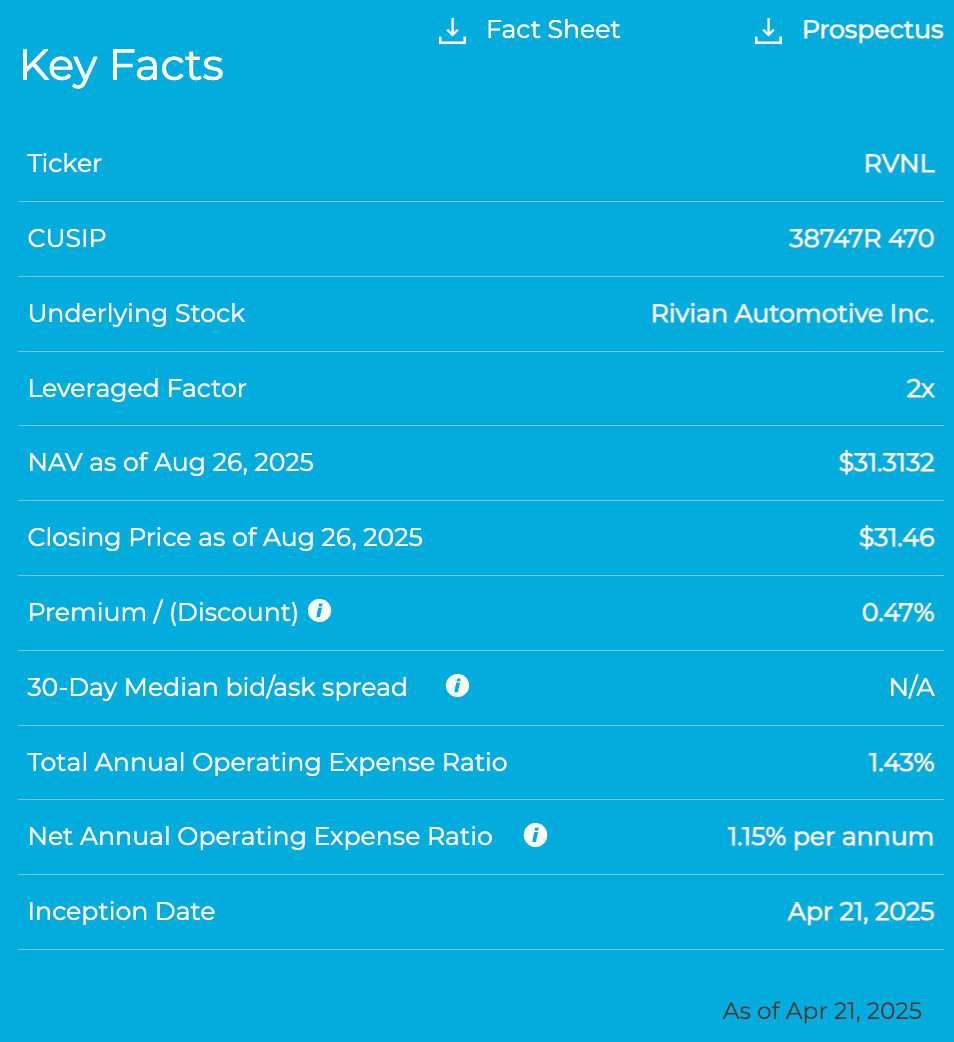

Pursue 2 times the daily percentage change of Rivian with the GraniteShares 2x Long RIVN Daily ETF (RVNL).

An investor should consider the investment objectives, risks, charges and expenses of the Funds (or of the investment company) carefully before investing. To obtain a prospectus containing this and other information, please call 1-844-476-8747. Read the prospectus carefully before you invest.

Important Information

Investors should consider the investment objectives, risks, charges and expenses of the GraniteShares funds (the “Funds”) carefully before investing. For a prospectus or summary prospectus with this and other information about the Funds, please call (844) 476 8747, or visit the website at www.graniteshares.com. Read the prospectus or summary prospectus carefully before investing.

To obtain a prospectus for the leveraged single stock ETFs, please visit https://graniteshares.com/media/j3dbjqmx/grsh-etf-trust-prospectus-s-l.pdf

Except as described above regarding the liquidation of the ETFs, shares of the Funds may be sold during trading hours on the exchange through any brokerage account, shares are not individually redeemable, and shares may only be redeemed directly from a Fund by Authorized Participants. There can be no assurance that an active trading market for shares in a Fund will develop or be maintained. Shares may trade above or below NAV. Brokerage commissions will apply.

Fund Risks

Multiple funds have a limited operating history of less than a year and risks associated with a new fund.

The Daily Leveraged Funds are not suitable for all investors. The investment program of the funds is speculative, entails substantial risks and include asset classes and investment techniques not employed by most ETFs and mutual funds. Investments in the ETFs are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily leveraged (2X) investment results, understand the risks associated with the use of leverage and are willing to monitor their portfolios frequently. For periods longer than a single day, the Fund will lose money if the Underlying Stock’s performance is flat, and it is possible that the Fund will lose money even if the Underlying Stock’s performance increases over a period longer than a single day. An investor could lose the full principal value of his/her investment within a single day. The funds do not directly invest in the underlying stock.

The Funds seek daily leveraged investment results and are intended to be used as short-term trading vehicles. Each Fund with “Long” in its name attempts to provide daily investment results that correspond to the respective long leveraged multiple of the performance of an underlying stock (each a Leveraged Long Fund).

Investors should note that the Long Leveraged Funds pursue daily leveraged investment objectives, which means that the fund is riskier than alternatives that do not use leverage strategies because the fund magnifies the performance of their underlying security. The volatility of the underlying security may affect a Funds' return as much as, or more than, the return of the underlying security.

For the Leveraged Long Funds because of daily rebalancing and the compounding of each day’s return over time, the return of the Fund for periods longer than a single day will be the result of each day’s returns compounded over the period, which will very likely differ from 200% of the return of the Underlying Stock over the same period. The Fund will lose money if the Underlying Stock’s performance is flat over time, and as a result of daily rebalancing, the Underlying Stock volatility and the effects of compounding, it is even possible that the Fund will lose money over time while the Underlying Stock’s performance increases over a period longer than a single day.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Inverse Risk, Market Risk, Counterparty Risk, Rebalancing Risk, Intra-Day Investment Risk, Daily Index Correlation Risk, Other Investment Companies (including ETFs) Risk, and risks specific to the securities of the Underlying Stock and the sector in which it operates. These and other risks can be found in the prospectus.

Investing in physical commodities, including through commodity-linked derivative instruments such as Commodity Futures, Commodity Swaps, as well as other commodity-linked instruments, is speculative and can be extremely volatile and may not be suitable for all investors. Market prices of commodities may fluctuate rapidly based on numerous factors, including: changes in supply and demand relationships (whether actual, perceived, anticipated, unanticipated or unrealized); weather; agriculture; trade; domestic and foreign political and economic events and policies; diseases; pestilence; technological developments; currency exchange rate fluctuations; and monetary and other governmental policies, action and inaction.

A liquid secondary market may not exist for the types of commodity-linked derivative instruments the Fund buys, which may make it difficult for the Fund to sell them at an acceptable price. The Fund is new with no operating history. As a result, there can be no assurance that the Fund will grow to or maintain an economically viable size, in which case it could ultimately liquidate.

Derivatives may be more sensitive to changes in market conditions and may amplify risks and losses.

This information is not an offer to sell or a solicitation of an offer to buy shares of any Funds to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Please consult your tax advisor about the tax consequences of an investment in Fund shares, including the possible application of foreign, state, and local tax laws. You could lose money by investing in the ETFs. There can be no assurance that the investment objective of the Funds will be achieved. None of the Funds should be relied upon as a complete investment program.

The Fund is distributed by ALPS Distributors, Inc, which is not affiliated with GraniteShares or any of its affiliates ©2024 GraniteShares Inc. All rights reserved. GraniteShares, GraniteShares Trusts, and the GraniteShares logo are registered and unregistered trademarks of GraniteShares Inc., in the United States and elsewhere. All other marks are the property of their respective owners.

Control GRS001544