The Fed convened for their latest meeting in early May and the meeting delivered largely what was expected. Which is to say that nothing really changed.

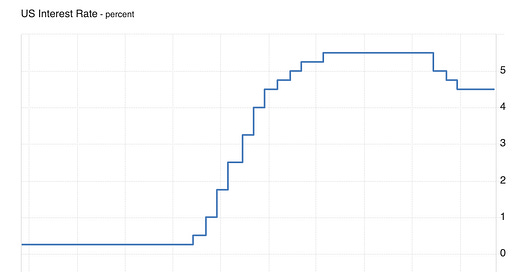

Powell and company held the Fed Funds rate steady, which was widely expected, and continued to take a wait-and-see approach before figuring out where to take policy next.

We feel that it’s a very defensible position. We’re still in the very early stages of getting the data necessary to determine what kind of impact tariffs are having on the global economy. Most of what we’ve gotten to this point have been sentiment and expectations readings. These are showing that confidence among consumers, investors and businesses are deteriorating, but we’re still a little light on tangible impact.

The markets, however, know that rate cuts translate to looser financial conditions. And that has the potential to lead to easier operating conditions for companies and better stock price performance. It sounds, however, like the Fed may not be leaning in that direction yet. On top of that, it’s unclear when the central bank might finally be ready to cut.

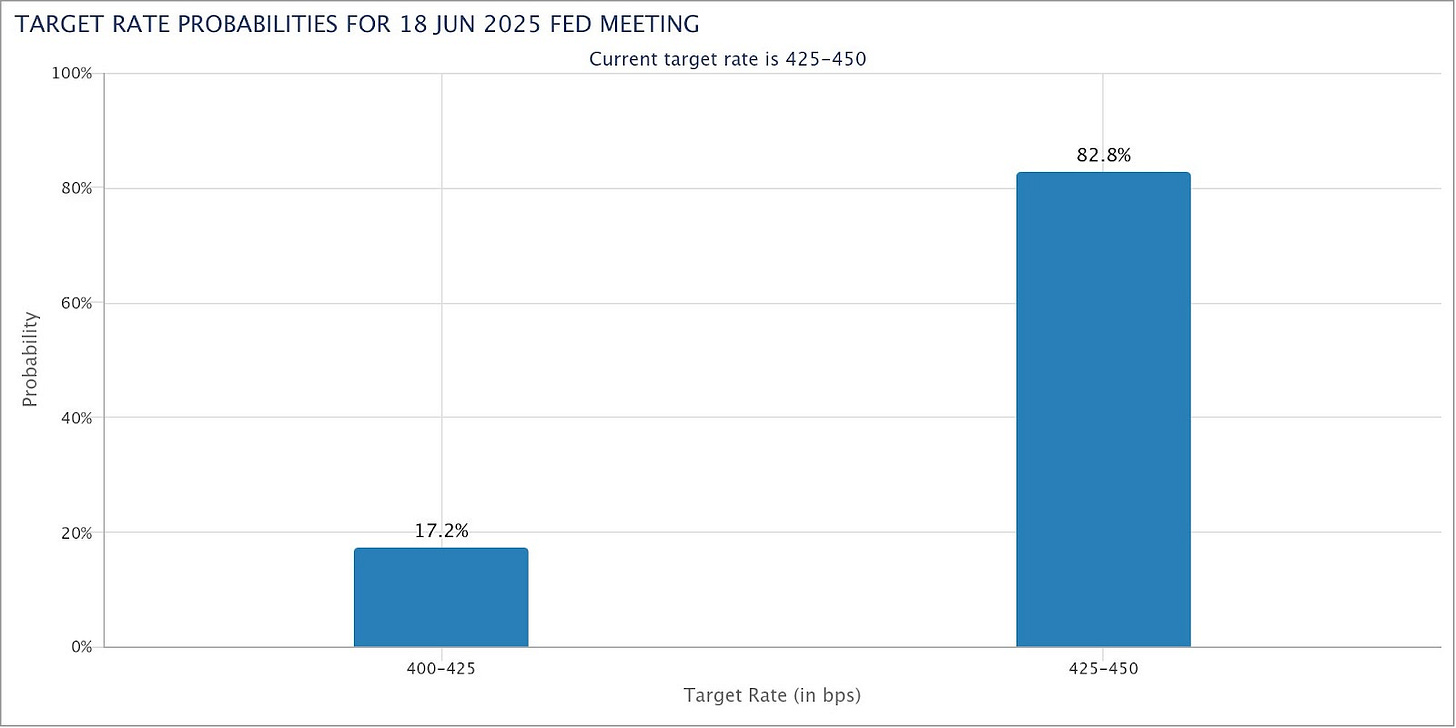

Many in the financial markets pegged the June meeting as a likely starting point for the Fed to cut rates. Following the May meeting and Powell’s cautious tone, the Fed Funds futures market thinks it’s quite unlikely that will happen now.

source: CME Group

The futures market doesn’t necessarily have a crystal ball when it comes to these things, but it does provide some insight as to what the market collectively might be thinking at any given moment. In this case, it’s telling us that the majority of traders are saying wait until the 2nd half of 2025.

Assuming that the market might be getting less monetary policy support than investors had originally anticipated, we feel that this could lead to a more challenging environment to decipher.

The one message that the Fed did seem to deliver is that it really doesn’t know either how this situation could play out. Powell is concerned both about inflation risk and the possibility of a recession, but the decision to hold off on policy changes could be a function of the uncertainty that seems to be engulfing the markets at the moment.

If you’re looking for an easy way to add gold exposure to your portfolio, consider the GraniteShares Gold Trust (BAR).

Disclosures

This material must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. To obtain a prospectus visit the link https://www.graniteshares.com/Documents/25/Prospectus-GraniteShares-Gold-Trust.pdf.

Shares of the Trust are not insured by the Federal Deposit Insurance Corporation (“FDIC”), may lose value and have no bank guarantee. BAR is not a mutual fund or any other type of Investment Company within the meaning of the Investment Company Act of 1940, as amended, and is not subject to regulation thereunder.

The Trust is not a commodity pool for purposes of the Commodity Exchange Act of 1936, as amended.

Trust shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of Trust shares relates directly to the value of the gold held by the Trust (less its expenses), and fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them. Shares of the Trust are bought and sold at market price. Brokerage commissions will reduce returns.

Market Price: The current price at which shares are bought and sold. Market returns are based upon the last trade price. NAV: The dollar value of a single share, based on the value of the underlying assets of the Trust minus its liabilities, divided by the number of shares outstanding. Calculated at the end of each business day.

Physical Replication: The Trust owns the underlying assets of the index whether they are stocks, bonds, or in this case, gold bars.

The objective of the Trust is for the value of the Shares to reflect, at any given time, the value of the assets owned by the Trust at that time less the Trust’s accrued expenses and liabilities as of that time. The Shares are intended to constitute a simple and cost-effective means of making an investment similar to an investment in gold. An investment in allocated physical gold bullion requires expensive and sometimes complicated arrangements in connection with the assay, transportation and warehousing of the metal. Traditionally, such expense and complications have resulted in investments in physical gold bullion being efficient only in amounts beyond the reach of many investors. The Shares have been designed to remove the obstacles represented by the expense and complications involved in an investment in physical gold bullion, while at the same time having an intrinsic value that reflects, at any given time, the price of the assets owned by the Trust at such time less the Trust expenses and liabilities. Although the Shares are not the exact equivalent of an investment in gold, they provide investors with an alternative that allows a level of participation in the gold market through the securities market.

An investor should consider the investment objectives, risks, charges and expenses of the Funds (or of the investment company) carefully before investing. To obtain a prospectus containing this and other information, please call 1-844-476-8747. Read the prospectus carefully before you invest.

ETF distributed by ALPS Distributors, Inc. (ADI)

Control GRS001278