Apple is one of the biggest companies in the world and one of the tech sector’s biggest influencers. It’s perhaps best known as the manufacturer of iPhones, but the development of Apple Intelligence within its devices also positions it as a major player in the AI revolution.

While the company delivered record revenue for the September quarter1, the market response was a little more tepid. The slow rollout of Apple Intelligence disappointed some investors who were hoping that its implementation would more strongly drive new iPhone sales. That resulted in a brief pullback in the stock’s price, but it has since regained its momentum.

source: StockCharts

Apple has been trading above its 200-day moving average since May, but its latest rally has pushed it above all of its major shorter-term moving averages as well. The 20-day moving average has served as a strong support level over the past month and the stock has continued to move higher as it broke through the double top around $237.

The MACD indicator2 still indicates positive momentum for the stock, although it has eased from its peak level of roughly a month ago. The RSI (or relative strength index), which, according to Investopedia, “measures the speed and magnitude of a security's recent price changes to detect overbought or oversold conditions in the price of that security”, has dipped back below the 70 level, which chartists would generally consider above that mark to be overbought conditions. We feel that Apple is still exhibiting positive momentum, but it may be showing signs of easing.

The Chande Trend Meter, another momentum indicator which, according to StockCharts, is “based on several different technical indicators covering six different timeframes”, is near multi-years highs. This may be indicating stronger momentum right now than what is being suggested from the previous two measures.

After moving sideways for much of July through October, Apple was able to re-establish its upward trend after the magnificent 7 stocks (consisting of Apple, Microsoft, NVIDIA, Amazon, Alphabet, Meta Platforms and Tesla) began outperforming the S&P 500. We feel that Apple is well-positioned to take advantage of the AI revolution, while sales of iPhones and other devices serve as the core revenue driver.

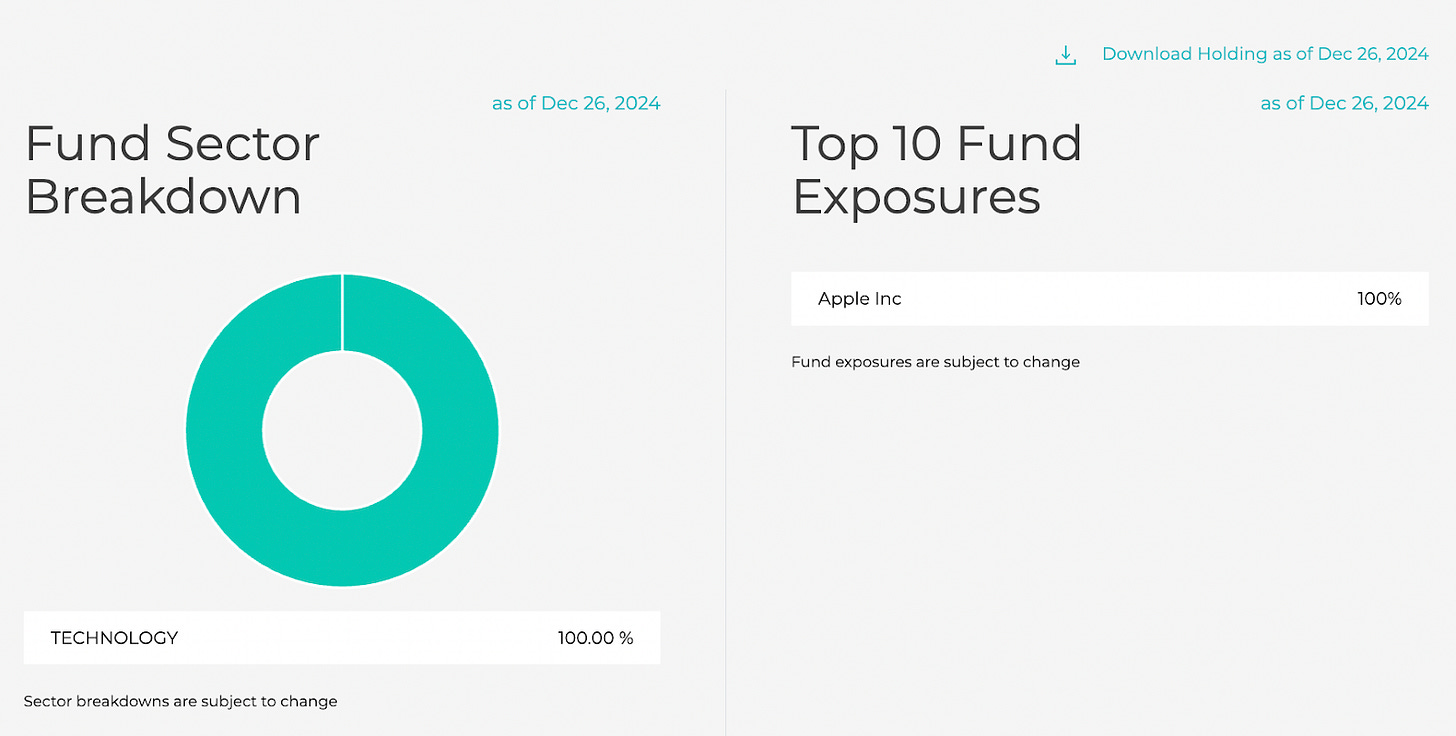

If you’re looking for an easy way to add enhanced Apple exposure to your portfolio, consider the GraniteShares 2x Long AAPL Daily ETF (AAPB).

1source: Apple earnings release

2According to Investopedia, the MACD (or moving average convergence/divergence) indicator is “a technical indicator to help investors identify price trends, measure trend momentum, and identify entry points for buying or selling.”

RISK FACTORS AND IMPORTANT INFORMATION

This material must be preceded or accompanied by a Prospectus. Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. Please read the prospectus before investing.

The Fund is not suitable for all investors. The investment program of the funds is speculative, entails substantial risks and include asset classes and investment techniques not employed by most ETFs and mutual funds. Investments in the ETFs are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.The Fund is designed to be utilized only by knowledgeable investors who understand the potential consequences of seeking daily leveraged (2X) investment results, understand the risks associated with the use of leverage and are willing to monitor their portfolios frequently. For periods longer than a single day, the Fund will lose money if the Underlying Stock’s performance is flat, and it is possible that the Fund will lose money even if the Underlying Stock’s performance increases over a period longer than a single day. An investor could lose the full principal value of his/her investment within a single day.

The Fund seeks daily leveraged investment results and is intended to be used as short-term trading vehicles. This Fund attempts to provide daily investment results that correspond to the respective long leveraged multiple of the performance of its underlying stock (a Leverage Long Fund).

Investors should note that such Leverage Long Fund pursues daily leveraged investment objectives, which means that the Fund is riskier than alternatives that do not use leverage because the Fund magnifies the performance of its underlying stock. The volatility of the underlying security may affect a Funds' return as much as, or more than, the return of the underlying security.

Because of daily rebalancing and the compounding of each day’s return over time, the return of the Fund for periods longer than a single day will be the result of each day’s returns compounded over the period, which will very likely differ from 200% of the return of the Underlying Stock over the same period. The Fund will lose money if the Underlying Stock’s performance is flat over time, and as a result of daily rebalancing, the Underlying Stock volatility and the effects of compounding, it is even possible that the Fund will lose money over time while the Underlying Stock's performance increases over a period longer than a single day.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Counterparty Risk, Rebalancing Risk, Intra-Day Investment Risk, Other Investment Companies (including ETFs) Risk, and risks specific to the securities of the Underlying Stock and the sector in which it operates. These and other risks can be found in the prospectus.

This information is not an offer to sell or a solicitation of an offer to buy shares of any Funds to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Please consult your tax advisor about the tax consequences of an investment in Fund shares, including the possible application of foreign, state, and local tax laws. You could lose money by investing in the ETFs. There can be no assurance that the investment objective of the Funds will be achieved. None of the Funds should be relied upon as a complete investment program.

An investor should consider the investment objectives, risks, charges and expenses of the Funds (or of the investment company) carefully before investing. To obtain a prospectus containing this and other information, please call 1-844-476-8747. Read the prospectus carefully before you invest.

ETF distributed by ALPS Distributors, Inc. (ADI)